All Categories

Featured

Table of Contents

In a lot of cases, you will certainly need to outbid various other financiers by offering to pay a higher premium (tax lien invest). This premium is usually less than the real quantity of tax obligations owed, yet it depends on the investor to choose if the risk deserves the collection benefit. In the majority of locations, residential or commercial property tax obligations are around one percent of the property's worth

Tax obligation lien investors make their cash on the rate of interest settlements they collect when the home owner repays the tax obligations they owe. In some places, these rate of interest prices are as high as 18 percent, which is greater than the average credit score card interest rate. Homeowner can pay what they owe at one time, or they can go on a settlement plan ranging from one to 3 years.

What Is Tax Lien Certificates Investing

In the above example, a person with a superior tax financial obligation of $4k (two years of back taxes) would be providing a tax lien holder with possibly up to $720 in interest repayments, dealing with the 18 percent rate of interest we pointed out previously. One of the best benefits to tax obligation lien capitalists is the potential to get a brand-new residential property for their actual estate portfolio, without having to pay its market price.

It's a win-win circumstance for the tax lien investor. There are some disadvantages to tax obligation lien investing.

When the lien is paid, the capitalist needs to proceed and search for a brand-new financial investment. Naturally, if the homeowner is still in default, the lien owner will acquire the residential or commercial property, which might come to be a persisting income. Somebody that purchases a tax obligation lien might find themselves entangled with other liens on the residential property, specifically if they finish up claiming the residential property in case the financial debt goes unpaid.

This can cause great deals of lawful battles, which is why it is very important to function with attorneys and tax obligation advisors who recognize things like deed vs title. and can aid with doing due diligence on a residential property. The laws around tax lien investing (and associated issueslike foreclosing on tenants) are not uniform across states that provide capitalists the ability to get involved in a tax obligation lien sale.

Considered that tax liens are frequently cost auction, completing bidders will certainly bid up the costs and bid down the passion price that can be gathered on the unpaid taxes. The victor of the auction will be the investor who is paying the greatest costs and obtaining the least expensive rates of interest in return.

Tax Ease Lien Investments Llc

In this vein, tax lien investing is a little extra sport-like than conventional passive means of gaining earnings. The first thing you'll wish to do is get aware of the area you're considering in regards to the realty market. Bear in mind that one advantage of coming to be a lienholder is gathering the residential property if the financial obligation goes unpaid, so you will certainly need to know where that building is.

Once you've found out these information out, you require to call your neighborhood region treasurer's office to figure out when and where the next tax obligation lien auction is being held. These auctions are usually held in individual, but in today's day and age, a number of have transitioned to on-line venues.

The majority of neighborhood papers publish these lists each year or semiannually. Remember that residential or commercial property taxes are usually one percent of the residential or commercial property value, however overdue tax obligations gathering over a number of years may be an extra substantial quantity.

Tax Lien Investing Strategies

it has actually the added perk of acquiring the property if the financial obligation remains overdue. While it can be a profitable opportunity for the investor, it does need some calculated footwork. Renters and building owners do have legal defenses that make tax obligation lien spending an extra involved procedure than just bidding to purchase a debt and waiting to collect the settlement.

Purchasing tax liens entails buying a legal insurance claim on a property as a result of overdue real estate tax. This approach of investing has obtained popularity because of its potential for high returns with reasonably low preliminary capital. Tax liens are generally cost auctions, and the process can differ depending upon the location.

Investors seek out tax liens for several reasons: 1. Low Initial Financial investment: Tax lien investing often calls for a little amount of money to start, making it accessible to a vast array of capitalists. Some tax liens can be purchased for as little as a couple of hundred bucks. 2. High Returns: The rate of interest on tax liens can be significantly greater than conventional investment returns.

Tax Lien Investing In Canada

3. Building Purchase: If the residential property proprietor fails to pay the past due taxes and rate of interest within the redemption period, the investor may can confiscate and obtain the property. Produce an account online, or call us for additional details. When financiers purchase a tax lien, they pay the past due taxes on a building and obtain a tax obligation lien certificate.

Payment by the Property Proprietor: The residential or commercial property owner pays off the overdue tax obligations plus rate of interest within a specific period, and the financier gets the payment with interest. Repossession: If the residential property owner does not settle the tax obligations within the redemption period, the capitalist can initiate foreclosure procedures to acquire the home.

The self-directed Individual retirement account purchases the lien certificate and pays connected fees. Tax Lien: The federal government sells a lien on the property due to unsettled tax obligations.

Investing In Real Estate Tax Liens

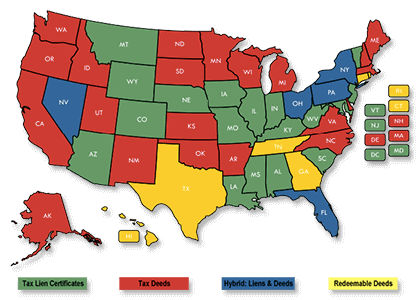

Tax obligation Act: The government markets the actual act to the residential or commercial property at auction. The winning bidder obtains possession of the building immediately. Some states utilize a hybrid strategy, where a lien might result in an action sale if not repaid. According to the National Tax Obligation Lien Organization (NTLA), 36 states and 2,500 jurisdictions within the United States permit for the sale of tax liens, while only 31 states enable tax obligation deed sales.

Latest Posts

Tax Repossessed Property

How To Do Tax Lien Investing

Investing In Tax Lien Certificates For Beginners